Living more than three years in Antalya, of course the first thing that is always on my mind is the economic situation in the country and the attitude of residents and foreigners to what has been going on for the last 3-4 years.

Since I am in the property business, this sector is always a litmus test, a very indicative indirect factor of the investment climate in a country.

There is an extremely lucid clue, which I found on the vastness of the Internet, and which determines the qualitative characteristics of the state according to a number of criteria. Everything is bad - bad - neutral - good and excellent. Let's go through these criteria and evaluate them.

But before we do, I would like to digress a little and make a small remark. Any market and development path is always cyclical. Roughly speaking, it is like the stock market - it is impossible to always only grow, there must be certain periods of correction, revision of strategy and decisions before a new stage of growth. The same cycles occur in any country. Somewhere they are sharp and fleeting, somewhere they are long-term and protracted. As an example, and a very telling example, is the property market and the economic model of the Emirates. Twice the country had a sharp market crash, in 2009 and 2015. Now over the last 9 years, this area is logically approaching its next correction cycle. In Turkey, the process simply started earlier, but the basis is always the fundamentals, which are complemented by the medium and long-term geopolitical picture.

Since I am in the property business, this sector is always a litmus test, a very indicative indirect factor of the investment climate in a country.

There is an extremely lucid clue, which I found on the vastness of the Internet, and which determines the qualitative characteristics of the state according to a number of criteria. Everything is bad - bad - neutral - good and excellent. Let's go through these criteria and evaluate them.

But before we do, I would like to digress a little and make a small remark. Any market and development path is always cyclical. Roughly speaking, it is like the stock market - it is impossible to always only grow, there must be certain periods of correction, revision of strategy and decisions before a new stage of growth. The same cycles occur in any country. Somewhere they are sharp and fleeting, somewhere they are long-term and protracted. As an example, and a very telling example, is the property market and the economic model of the Emirates. Twice the country had a sharp market crash, in 2009 and 2015. Now over the last 9 years, this area is logically approaching its next correction cycle. In Turkey, the process simply started earlier, but the basis is always the fundamentals, which are complemented by the medium and long-term geopolitical picture.

What are the disadvantages now?

Western model and full integration into it

Orientation and concentration in the eastern direction

Finding the golden mean and maximising the benefits both ways

- Quite big problems in the financial system of the country. First of all, these are the well-known problems related to devaluation and inflation in the country.

- In Turkey, there is now a global choice between the direction where the country sees itself in the medium-term future.

Western model and full integration into it

Orientation and concentration in the eastern direction

Finding the golden mean and maximising the benefits both ways

- Spoilt business reputation of the country for foreign investors, which was allowed by inept attempts to find a balance. This is also the root cause of the first point.

- The past earthquake which has caused significant damage to the country’s economy

- The global most interesting markets are closed for a country with such a huge production potential. In other words, Turkey can produce and earn many times more, but it is prevented from doing so. First of all, the European Union. In general, they are doing the right thing, protecting their market, because they are afraid.

On the other side of the scales, what do I see as the pluses?

- A productive and technologically advanced state. Roughly speaking, to a large extent, the country provides for itself. From cars to household appliances, clothes, food, medicines. There are hundreds of thousands of medium and small strong enterprises in the country.

- The geographical location I find simply superb. Clearly in the centre of all transport and financial flows.

- Geopolitical neutrality, so called guttaperchy. Once all current turmoil is removed, the country will have no pronounced enemies.

- The country has democracy. Frankly speaking, there is some kind of democracy. And a vivid example is when the opposition completely won the last municipal elections. Can you imagine such a thing in our country?

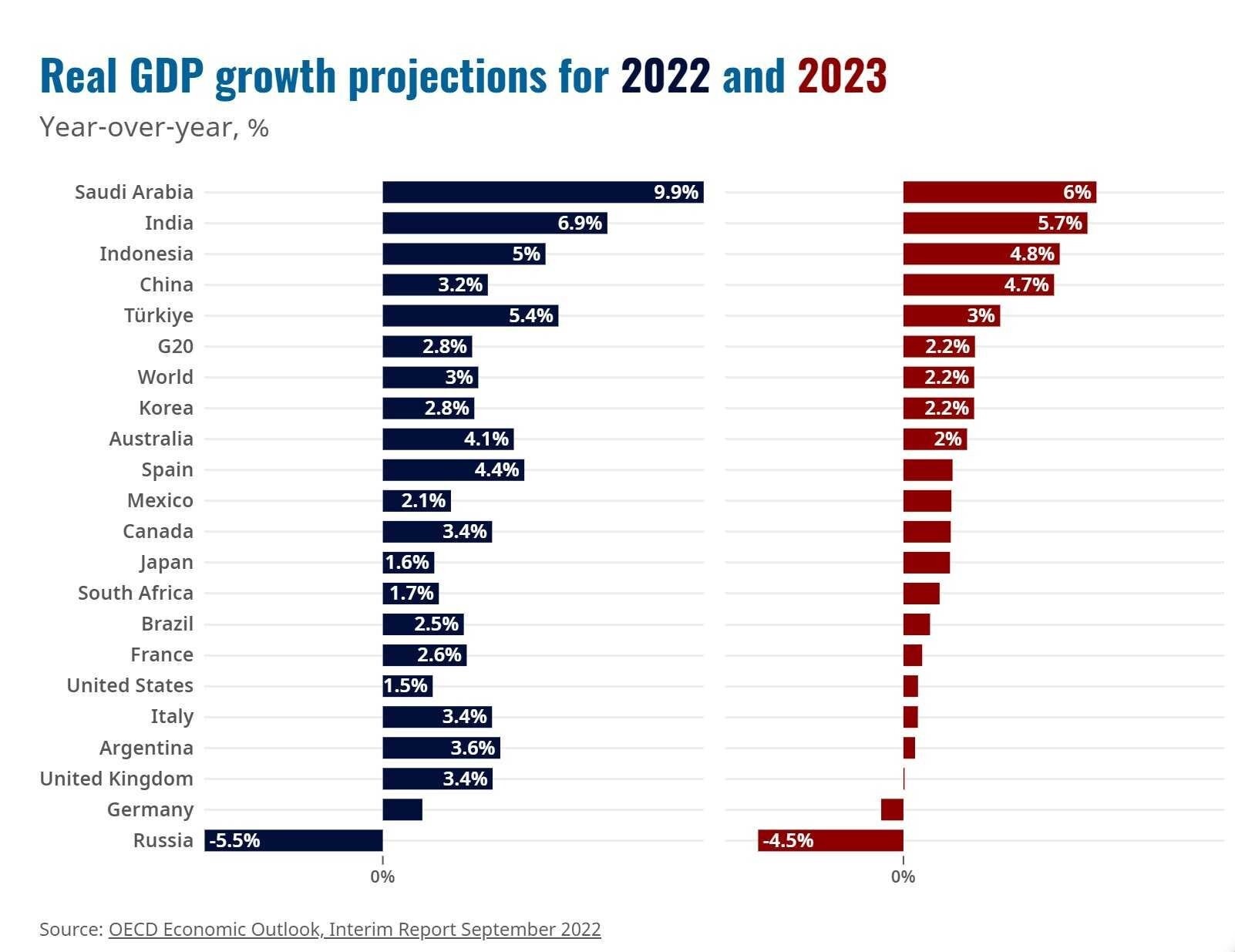

- Turkey's economic growth rate is consistently in the top 4 of the G20 countries.

- There are no state corporations as such in the country. A fair business climate for those who work the hardest and try the hardest.

- And of course, there is no so-called Dutch syndrome - Turkey is not sitting on an oil needle. It has an agricultural sector, one of the most developed tourist sectors in the world, and a manufacturing base: they produce everything from cars to aeroplanes. I know more than 10 local brands of household appliances alone. Now the so-called free economic zones are actively developing, where the main investor is the re-locants of the EU production.

- And one more thing that not everyone knows about. The whole economic model of the country is divided into so-called prefectures. Roughly speaking, the municipality of Antalya has its own budget, which it disposes of at its discretion for the benefit of the region. No money from above and their uncontrolled spending, which naturally strongly provokes corruption and theft.

- Corruption - as a long-time resident, I will say it carefully. All issues are solved, but not for money. Direct extortion of bribes in the country is severely punished.

Let's go back to my picture and walk through it.

The Risk Factor.

Every country has it. It's war, civil war, the same earthquake. I don't see any preconditions for any of them at the moment. What's more, we have a visa-free regime with our long-time opponent Greece and a good dialogue. The situation is the same with the Arab world. Ecological relations are being built everywhere, without distortions.

Level of economic growth

The Risk Factor.

Every country has it. It's war, civil war, the same earthquake. I don't see any preconditions for any of them at the moment. What's more, we have a visa-free regime with our long-time opponent Greece and a good dialogue. The situation is the same with the Arab world. Ecological relations are being built everywhere, without distortions.

Level of economic growth

According to the results of 2023, Turkey has entered the top 5 economies of the world in terms of growth rate. At the same time, in 2022 the country was in the 3rd place. Roughly speaking, after revising the external and adapting the geopolitical course, growth will only increase as there is a strong foundation.

Political activity

Here I have already expressed my opinion. The country has at least stability without abrupt changes, with elements of a strong enough democracy. And the last elections were very indicative in this respect. People can actively express their opinions, and they are considered. As an example, do people want foreigners to be oppressed? Okay, let's oppress them. That's the will of the people, even though it goes against common sense. It's like a game, if I may say so. And after the elections, on the contrary, we will weaken everything, as it is in the interests of the state, which is what is happening now.

Market size

Turkey's GDP in 2023 is $3 trillion. For comparison, in Russia this figure is 4.7 trillion. Now compare our vast country in terms of geography and ambitions and some Turkey. As it turns out, Turkey's economy is only 37% smaller. Not many times, not dozens of times. And with such growth rates, I would not be surprised if it catches up with Russia within the next 10 years. Although for many people it's just some resort country with hotels in Antalya.

Dependence on foreign aid

And in general, there is none. Nobody lends to the country, and this is the biggest problem of Turkey now. But it does not need help as such, it is not poor. It's just not developing.

The size of the foreign debt

Political activity

Here I have already expressed my opinion. The country has at least stability without abrupt changes, with elements of a strong enough democracy. And the last elections were very indicative in this respect. People can actively express their opinions, and they are considered. As an example, do people want foreigners to be oppressed? Okay, let's oppress them. That's the will of the people, even though it goes against common sense. It's like a game, if I may say so. And after the elections, on the contrary, we will weaken everything, as it is in the interests of the state, which is what is happening now.

Market size

Turkey's GDP in 2023 is $3 trillion. For comparison, in Russia this figure is 4.7 trillion. Now compare our vast country in terms of geography and ambitions and some Turkey. As it turns out, Turkey's economy is only 37% smaller. Not many times, not dozens of times. And with such growth rates, I would not be surprised if it catches up with Russia within the next 10 years. Although for many people it's just some resort country with hotels in Antalya.

Dependence on foreign aid

And in general, there is none. Nobody lends to the country, and this is the biggest problem of Turkey now. But it does not need help as such, it is not poor. It's just not developing.

The size of the foreign debt

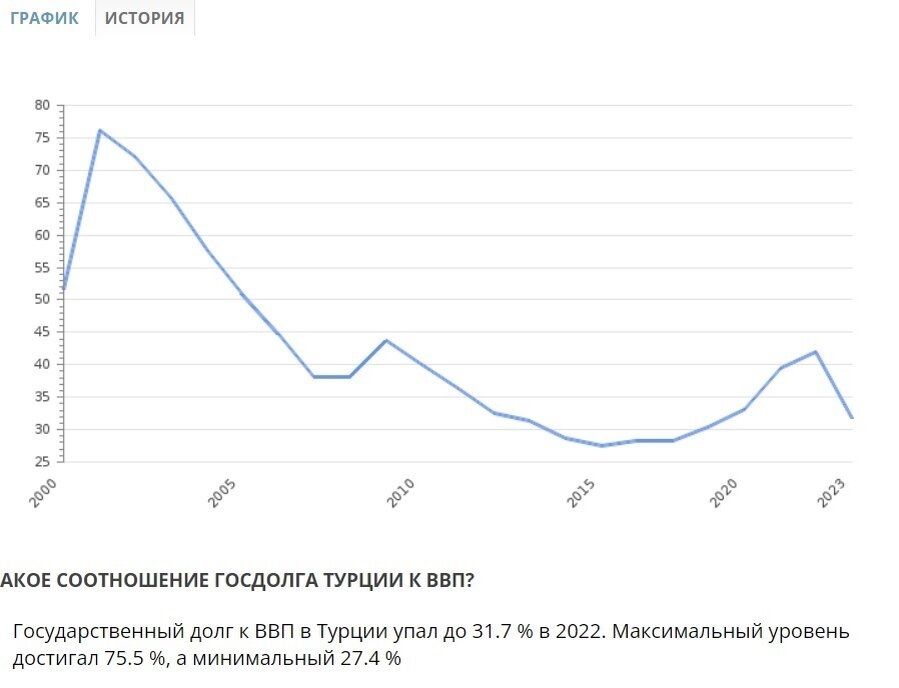

A very telling picture. Debt is at its lowest historical level. In percentage terms, it is less than 30 per cent. This is not crazy trillions, or a ratio of 100 per cent or more to GDP, which it is not clear how future generations will be served. It's a perfectly comfortable figure that can then become a good foundation for cheap money to flow into the economy. I won't say that this is a good thing, it is more an indication that the country can't borrow on comfortable terms if it wants to, as there is a huge need for new investment projects in Turkey. And it is this vicious circle that I understand the government is now actively solving, essentially negotiating.

Currency convertibility

Here everything is simple. The Turkish lira is not a dollar, yen or euro. But it is absolutely unrestricted worldwide and 100% backed by gold.

Currency strength

As soon as the external barriers to the multiple growth of exports from the country will be removed, and the country is right at a low start, there are more than 15 automobile factories, the specific weight of the national currency will grow. At the moment, the lira is closed in its own economy, well, maybe partially it plays a role in the neighbouring countries that are in the grip of sanctions, it is Iran and Russia. But the country will not make large volumes here, maybe it will only earn money.

The level of infrastructure development

Those who have been in this country will unequivocally say that it is at a very high level. As an indicator, driving the car out of Russia all the way I was acutely worried about my low-profile wheels on most of the roads of our country, and of course especially in Georgia. Only when I entered Turkey, I exhaled, as the road system here is simply excellent.

Currency convertibility

Here everything is simple. The Turkish lira is not a dollar, yen or euro. But it is absolutely unrestricted worldwide and 100% backed by gold.

Currency strength

As soon as the external barriers to the multiple growth of exports from the country will be removed, and the country is right at a low start, there are more than 15 automobile factories, the specific weight of the national currency will grow. At the moment, the lira is closed in its own economy, well, maybe partially it plays a role in the neighbouring countries that are in the grip of sanctions, it is Iran and Russia. But the country will not make large volumes here, maybe it will only earn money.

The level of infrastructure development

Those who have been in this country will unequivocally say that it is at a very high level. As an indicator, driving the car out of Russia all the way I was acutely worried about my low-profile wheels on most of the roads of our country, and of course especially in Georgia. Only when I entered Turkey, I exhaled, as the road system here is simply excellent.

And further down the line:

Good banking system

Good banking system

- Excellent education, which attracts a large number of foreigners.

- Medicine. We have a whole pilgrimage for dentistry, trichology and cosmetic clinics in Antalya. This is by the way the next trend for the country - medical tourism.

- Social Infrastructure of small and large cities is always at a high level, it is the so-called standard.

There's probably some sort of summation to be made here. Here is how I see it.

Inflation and devaluation are the current and the main factor of turmoil in the country's economy. It has become expensive to live, many sectors of the economy are suffering. And it is this factor that is now being actively addressed. I will say more - it is in fact the main one and does not overlap with other global problems for the economy. Turkey is not under sanctions, is not hostile, is in an ideal geographical location, is not one of the countries with ineffective governance and a high degree of corruption, has an excellent infrastructure. It does not violate the rights of owners and investors, roughly speaking, it does not squeeze out factories or usurp property. The latter, I believe, is a so-called black mark on the investment climate of any country, it is very fraught in the future.

As soon as the path of correction is over, which is now at the finishing stage, Turkey will shine with other colours for all those who now look at this economic phenomenon with scepticism. And it will be the turn of the neighbouring countries to enter the correction period, but do these countries have fundamentals? And I'm talking about the Arab Emirates, for example. I don't see them there, and the crisis will be very strong there, because 80% of the country's money is made by foreign investors, and they are very easy on emotions.

Inflation and devaluation are the current and the main factor of turmoil in the country's economy. It has become expensive to live, many sectors of the economy are suffering. And it is this factor that is now being actively addressed. I will say more - it is in fact the main one and does not overlap with other global problems for the economy. Turkey is not under sanctions, is not hostile, is in an ideal geographical location, is not one of the countries with ineffective governance and a high degree of corruption, has an excellent infrastructure. It does not violate the rights of owners and investors, roughly speaking, it does not squeeze out factories or usurp property. The latter, I believe, is a so-called black mark on the investment climate of any country, it is very fraught in the future.

As soon as the path of correction is over, which is now at the finishing stage, Turkey will shine with other colours for all those who now look at this economic phenomenon with scepticism. And it will be the turn of the neighbouring countries to enter the correction period, but do these countries have fundamentals? And I'm talking about the Arab Emirates, for example. I don't see them there, and the crisis will be very strong there, because 80% of the country's money is made by foreign investors, and they are very easy on emotions.

How does this one feel about the property market?

Warren Buffett's golden phrase is ‘buy when it bleeds.’

Right now, at the end of the recession, foreign flat owners are selling. They're selling them cheap. It's emotion, and the Turkish owners have almost none. They have no hurry, they'll wait. They live in their own country. And just now I see on the market a large number of offers for 75.000 -80.000 dollars in new complexes in the same Antalya. Is it right? I am sure it is not, they will not buy anything for that money. Migration rules will return to the level when nobody had any questions, let's remember 2015-2021. And the fundamental and strong sides of the country will remain, but there will be a residue in the form of a damaged investment reputation of the country, which will sooner or later be forgotten.

Warren Buffett's golden phrase is ‘buy when it bleeds.’

Right now, at the end of the recession, foreign flat owners are selling. They're selling them cheap. It's emotion, and the Turkish owners have almost none. They have no hurry, they'll wait. They live in their own country. And just now I see on the market a large number of offers for 75.000 -80.000 dollars in new complexes in the same Antalya. Is it right? I am sure it is not, they will not buy anything for that money. Migration rules will return to the level when nobody had any questions, let's remember 2015-2021. And the fundamental and strong sides of the country will remain, but there will be a residue in the form of a damaged investment reputation of the country, which will sooner or later be forgotten.